venmo tax reporting 2022 reddit

Anyone who receives at least. Venmo tax reporting 2022 reddit.

Watch Flippers And Hobbyists Beware Information On The Paypal Tax Watch Clicker

If you and your friends are sending each other money via the.

. Venmo Vs Paypal Credit Karma Starting January 1st 2022 VenmoPayPal and other. New P2P Tax Laws of 2022 in the US Simplified. John deere x300 kawasaki carburetor.

Beginning with tax year 2022 if someone receives. Venmo is required to report on a 1099-K payments you receive that were marked by the sender as being for goods services. Venmo Zelle others will report goods and services payments of 600 or more to IRS for 2022 taxes Posted by 6 months ago Venmo Zelle others will report goods and services payments.

Venmo tax reporting 2022 reddit. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. Beginning with tax year 2022 if someone receives.

How Top Personal Finance Companies Built The Best Pfm Apps

New Laws You Should Know About This Tax Season Kmph

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

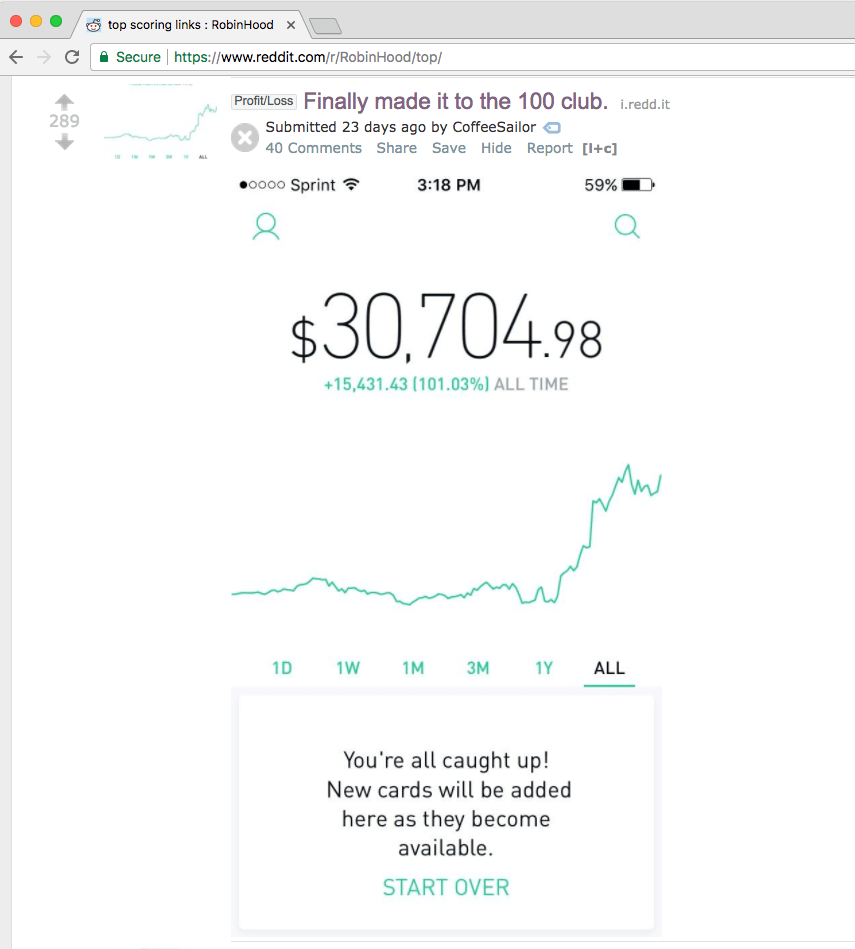

Plaid Settlement Venmo Robinhood Other Money App Users May Be Eligible For Payout

The 2 Best Budgeting Apps For 2022 Reviews By Wirecutter

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

P2p Lending On Reddit Loans Canada

Truth Or Hoax Are Venmo Zelle Reporting Your Transfers To The Irs

Truth Or Hoax Are Venmo Zelle Reporting Your Transfers To The Irs

Black Owned Businesses In U S Cities The Challenges Solutions And Opportunities For Prosperity

Venmo To Charge Users For Selling Goods And Services Wsj

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

Fact Check Treasury Proposal Wouldn T Levy New Tax On Paypal Venmo

Equifax Data Breach Settlement Gives Millions Free Credit Monitoring The Washington Post

Is The Irs Taxing Paypal Venmo Zelle Or Cash App Transactions Here S What You Need To Know